Should Biden’s Debt Forgiveness Program be Implemented?

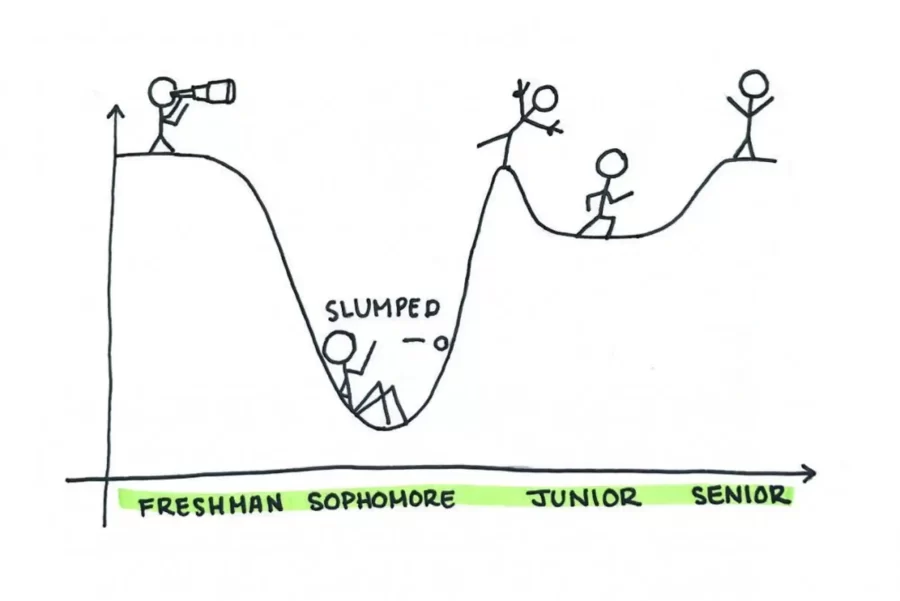

Being a senior and all, I’ve been thinking a lot about college lately. One of the most stressful things about the whole application process is trying to get the loans I need to be able to afford college at all. Well, the answer may have just presented itself. President Joe Biden recently launched a program that will aim to forgive around $500 billion in student debt. This is, as I’m sure you’re aware, a lot of money. So, where is the federal government getting all this money from? And how is it being distributed? Before we can answer that question, we must first look into how student government loans work.

There are three main types of student government loans: direct subsidized loans, direct unsubsidized loans, and parent PLUS loans. The most desirable of these is direct subsidized loans because the government pays the interest on your debt while you’re in school and for up to six months after you graduate. After this grace period, the average interest charged on your debt is around 5% (for undergraduate borrowers). Unsubsidized loans, on the other hand, do accumulate interest while you’re still in school. Additionally, parent PLUS loans are federal loans that parents of dependent undergraduate students make in order to assist with their child’s college expenses.

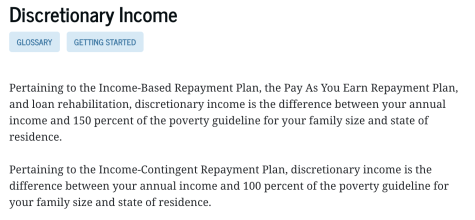

There are a few ways to pay back your loans from any kind of government aid. First, you have the Graduation Repayment Plan, which starts your payments off lower and gradually raises them over a period of 10 years. A more common method of paying back student loans is Income Based Repayment, which sets your payments at 10-15% of your monthly discretionary income, which you pay for around 20-25 years. The advantage of this plan is that you’re paying less in the individual payments, but you’re paying it for twice as long as you might with other plans, which means that you’re accumulating more interest. The idea behind repayment plans is that the government gives you money for school, and, once you graduate and your degree allows you to get a job, you have to pay the government back including interest to account for inflation.

This brings us back to our first question: where is the government getting the $500 billion that they can just forgive? That’s no casual sum of money. In a report from the Congressional Budget Office, they state that reduced cash flow to the Treasury will cause an increase in the amount of money the federal government will have to borrow over roughly the next 30 years. In other words, Biden’s plan will inevitably contribute to the United States’ national debt. But, it appears that the pros may outweigh the cons.

Biden outlines three main steps in his program: providing targeted relief to borrowers with loans held by the Department of Education, making the student loan system more manageable for current and future borrowers, and reducing the cost of college by holding colleges accountable when they raise tuition prices. The general hope is that, by fixing the root of the problem, the federal deficit acquired over the next 30 years of debt forgiveness will eventually even out and become a system that works for both borrowers and the federal government.

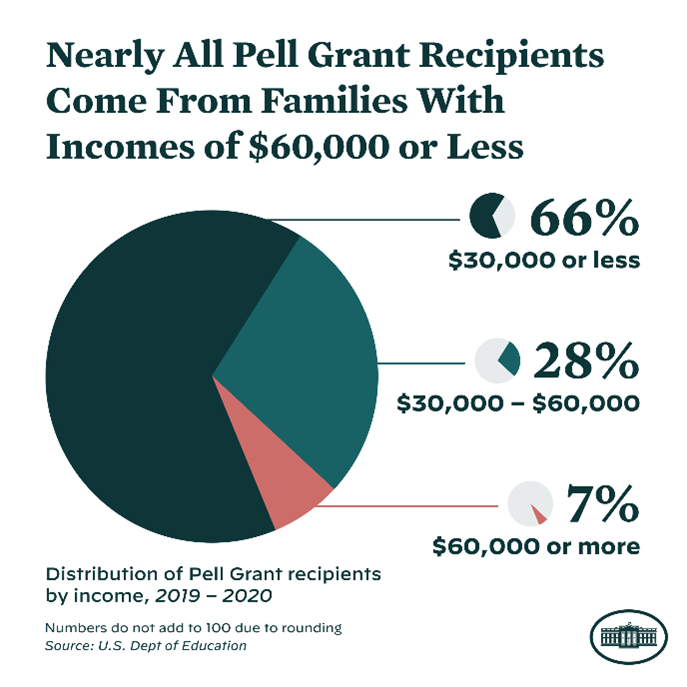

The first step of the program, targeted relief, works like this: the federal government will pause student loan debt repayments through December 31st, 2022. After this, repayments will begin, but with a few changes. First off, the Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department, and up to $10,000 in debt cancellation for non-Pell recipients. The reason for this is that, according to the US Department of Education, nearly all Pell Grant recipients come from households or families with incomes of $60,000 or less. Borrowers with an individual income of over $125,000 a year are not eligible for this cancellation. No high-income individual or household (defined as being in the top 5% of incomes) will benefit from this action.

The second part of the program has a few more working parts. To make the student debt payment system more manageable, Biden has worked with the Department of Education to propose a new income-based repayment plan that is designed to protect more low-income borrowers. The existing income-driven repayment plan cancels a borrower’s remaining debt once they make 20 years of monthly payments, but the Department of Education has decided that the existing versions of this plan are too complicated and too limited. The new income-driven repayment plan caps monthly payments at 5% of the borrower’s discretionary income, which is half as much as the previous 10% charged in the original income-based repayment plan. This lowers average annual student loan repayment by more than $1,000, according to the fact sheet put out by the Biden administration on August 24th. This new plan also raises the amount of income that is considered non-discretionary, protecting it from repayment. This guarantees that no borrower earning under 225% of the federal poverty level will have to make monthly payments. This plan also cuts the federal student debt forgiveness period in half, meaning that any remaining debt a person has will be forgiven after 10 years instead of 20. Finally, this part of the plan also covers the borrower’s unpaid monthly interest, ensuring that your monthly loan balance will not grow as long as they make their monthly payments, even if that payment is $0.

Finally, the third part of this plan is to lower the tuition prices of the actual colleges. President Biden backed the biggest increase to Pell Grants in over a decade. It was also one of the largest one-time influxes to colleges and universities. This is aiming to over double the maximum Pell Grant and make community colleges completely free. Colleges also have an obligation under this program to keep prices reasonable.

Biden also claims this program will aim to help increase racial equity. According to the White House briefing room, “By targeting relief to borrowers with the highest economic need, the Administration’s actions are likely to help narrow the racial wealth gap.” The release cites an Urban Institute study that found that debt forgiveness programs targeting people who received Pell Grants while in college will advance racial equity.

Nearly 8 billion borrowers may be eligible to claim relief. All in all, because of the measures taken to change and improve the current and future system of federal student debt, Biden’s Debt Relief Program may turn out to be the thing that allows more people to go to college, and more borrowers to lift a major weight of their chest.

Eli is a senior at GALA and a staff writer for The Echo. Though this is his first year in the journalism elective, it is far from his first experience...

Byanca F. • Nov 2, 2022 at 5:01 pm

When reading this article, I did not feel worried about college. Even though I am too young to be thinking of college. I really liked the format of this article, and the way it was written. Great job.